Tips for Seniors Wanting to Help Relatives

| Posted in Fraud Prevention

Be on guard against phone calls from con artists who target seniors. A common scam involves an imposter pretending to be a relative in trouble. ("My wallet was stolen" or "I'm in jail.") These callers do enough homework to mention the name of the relative or other people the senior citizen knows. And by "crying," it is difficult to recognize the voice. The scammer usually pleads for money to be sent immediately by wire transfer and to not tell any family members for fear of upsetting them. In one variation, the caller may instead claim to be a lawyer, police officer or someone else trying to "help" your relative.

"Many older individuals will immediately jump to the assistance of a relative, without asking questions that would verify the caller's identity," said Marybeth Bannon, an FDIC Consumer Affairs Specialist. "In this situation, always check with another family member about whether your relative actually is in trouble and needs money and only wire money to people you know. Don't wire money to strangers who claim they are helping your family."

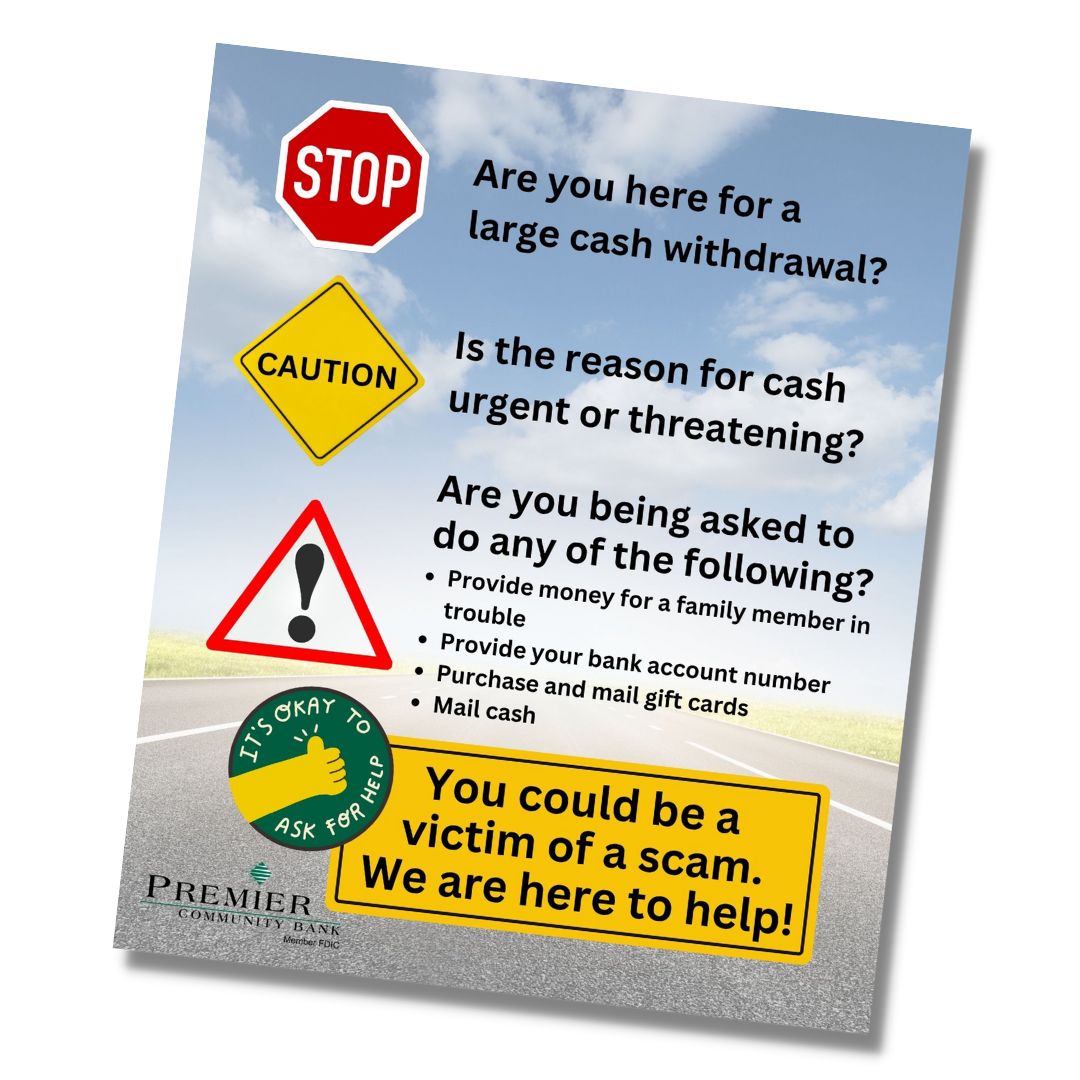

You may see these on our tellers lines as another resource to consider if you are being scammed or not. If you are unsure are tellers would be happy to help you!

Understand the potential pitfalls of co-signing a loan for a relative. It's tempting to help a loved one borrow money for that first car, credit card or student loan, but by doing so you will be liable for the full amount of the debt, plus interest, if he or she doesn't pay what's due.

"Even though co-signing is a well-intended gesture, a defaulted loan could be difficult to repay — especially on a fixed income — and it can be costly and stressful in terms of the possibility of damaging your credit history and dealing with a debt collector," said FDIC Supervisory Consumer Affairs Specialist Kirk Daniels.

Although creditors are required to provide a notice to a co-signer about the debt obligation, Daniels said the FDIC occasionally hears from older co-signers "who didn't fully understand what they were agreeing to in terms of payment responsibilities." Remember, when you co-sign a loan or otherwise sign up as a "guarantor," you are agreeing to become just as liable to pay the loan as the other borrower.

Talk with your younger relatives about how to manage money and use banking services responsibly. "Research indicates that parents or other family members regularly talking with a child about basic financial concepts — starting early and into adulthood — is an effective and lasting way to help develop sound money-management skills," said Luke W. Reynolds, Chief of the FDIC's Outreach and Program Development Section. "Teaching self-control, the ability to delay gratification, and basic math skills early on can lay a foundation for years later, when you are teaching the youngster concepts such as the benefits of saving money for a sizable purchase, perhaps a car or bicycle, and how to wisely manage credit."

Explore ways to save money for a child. If you want to help pay for a younger relative's education expenses, such as tuition for college, you may want to open a tax-advantaged 529 Account or Coverdell Education Savings Account. As long as all funds are used for qualified educational purposes, the money earned will not be taxed. Another aspect of 529 accounts is that you determine how the funds are spent.