We are more than a bank.

Bank employees made Premier what we are today, and will continue to be what makes the difference in the future. We are more than a bank—we are a part of your stories, your milestones, your dreams. As we look to the future, we carry the same promise that brought us here: to grow with you, to stand by you, and to build a legacy that lasts for generations to come.

The Premier Community Bank story begins with the opening of Marion State Bank.

2025

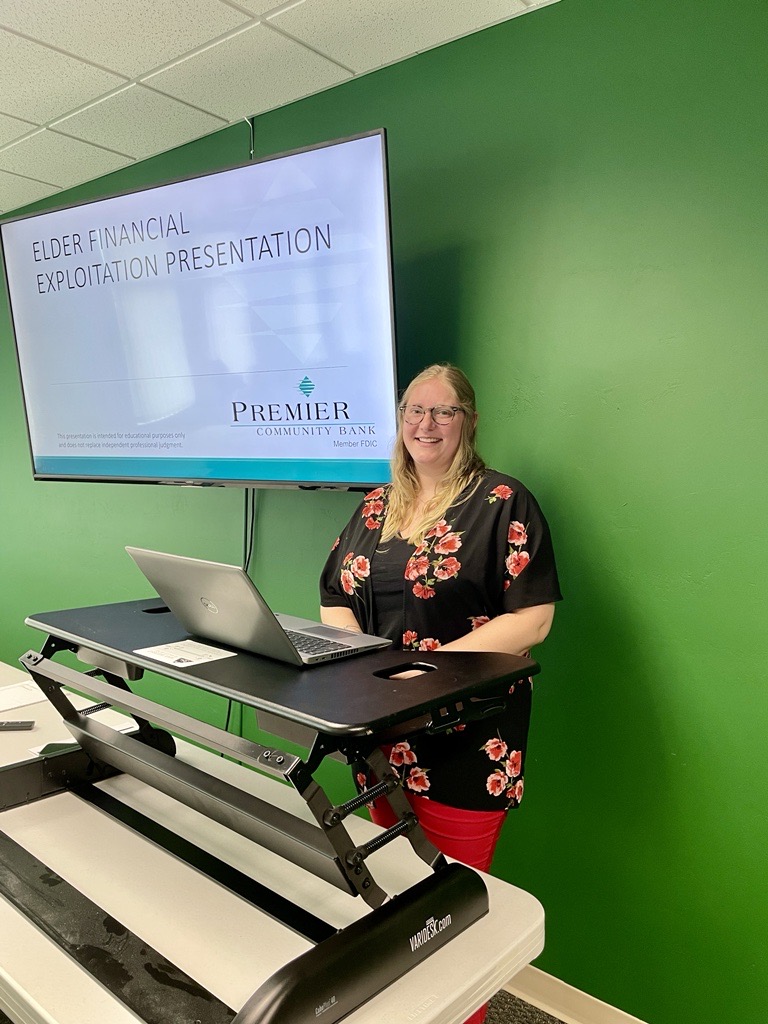

Introduced Full-time Fraud Specialist

Added a position solely dedicated to assist and educate customers on fraud.

2024

$500 Million in Assets

Half a billion strong: The Bank reached a key milestone of $500 million in assets.

2024

Newly Built Winneconne Branch Opens

Opened our state-of-the-art branch in Winneconne, reflecting our commitment to innovation.

2025

Introduced Full-time Fraud Specialist

Added a position solely dedicated to assist and educate customers on fraud.

2024

$500 Million in Assets

Half a billion strong: The Bank reached a key milestone of $500 million in assets.

2024

Newly Built Winneconne Branch Opens

Opened our state-of-the-art branch in Winneconne, reflecting our commitment to innovation.

1941

Marion State Bank Begins

Founded in 1941, Marion State Bank opened amidst WWII, providing financial stability to its community during uncertain times.

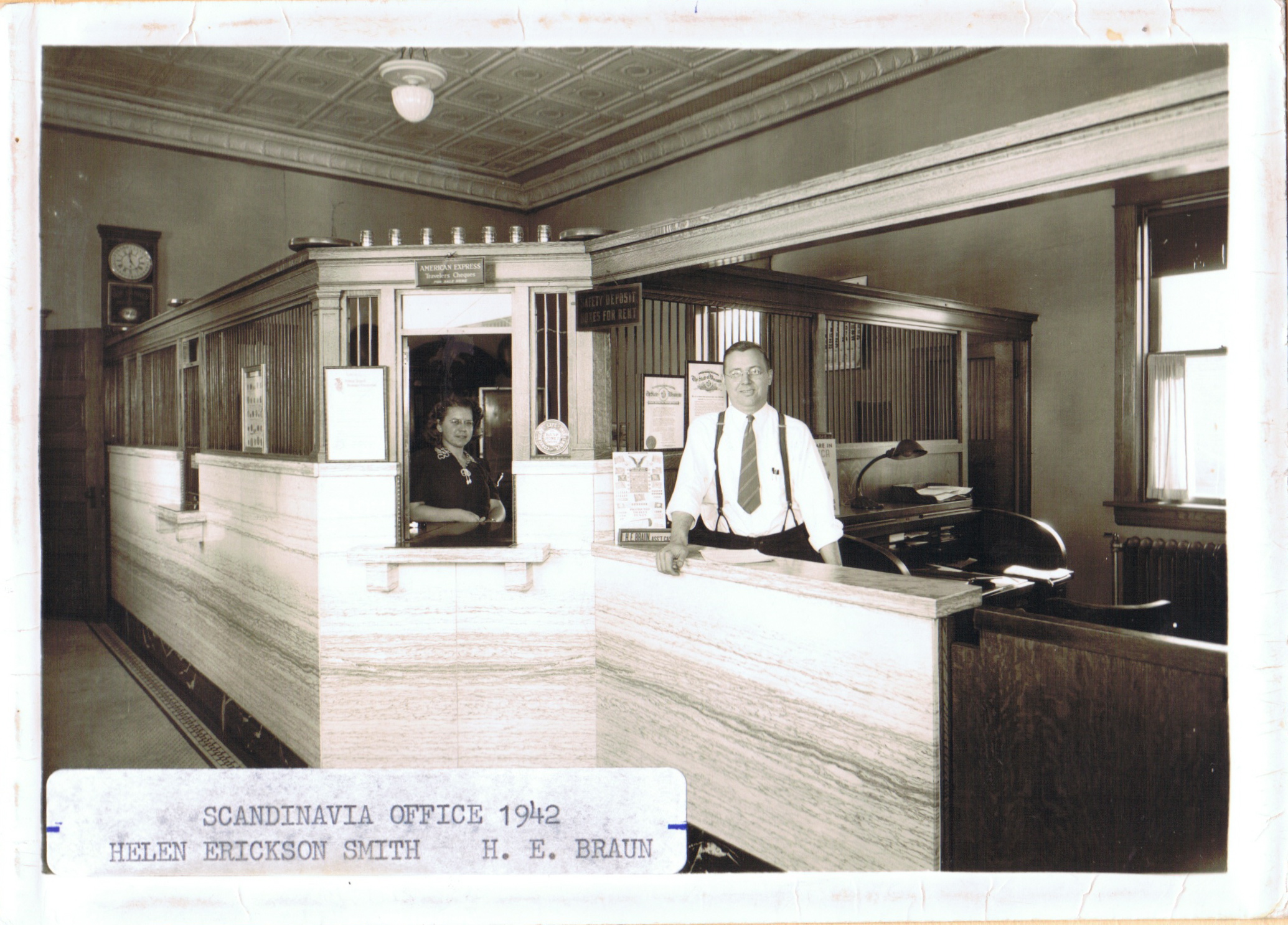

1942

Scandinavia Branch Opens

The Bank expanded to Scandinavia, Wisconsin, ensuring local families and businesses had access to essential banking services during wartime.

1943

Bear Creek Branch Opens

Continuing growth, a new branch in Bear Creek reinforced the Bank’s commitment to serving rural Wisconsin communities.

1983

First Personal Computers

Embracing innovation, we introduced personal computers to enhance banking efficiency.

1991

Iola Branch Opens

The Bank expanded to Iola, strengthening financial accessibility in the region and supporting local economic development.

1995

Investment Services

Recognizing customers’ evolving needs, the Bank launched its Investment Services, offering personalized financial planning and wealth management services.

1998

Tigerton & Bonduel Branches Open

Branches opened in Tigerton and Bonduel continued the Bank’s mission to serve rural communities.

1998

First ATM installed in Marion

Convenience redefined: Our first ATM in Marion offered 24/7 banking access.

1998

Insurance Services Begin

Expanding our services, we launched Insurance Services to meet diverse customer needs.

2000

Name Change to Premier Community Bank

Reflecting our growth, Marion State Bank rebranded to Premier Community Bank.

2000

Website Launch

Stepping into the digital age, we unveiled our website for online banking convenience.

2001

Pulaski Branch Opens

Extended our reach with the opening of our Pulaski branch.

2006

Shawano Branch Opens

Furthering our commitment, we launched the Shawano branch.

2007

$200 Million in Assets

Doubled our size, reaching $200 million in assets.

2012

Branch Acquisitions

Expanded our footprint by acquiring branches in Manawa, Waupaca, King, and Fremont.

2015

Winneconne Branch Opens

The Winneconne branch opened, further expanding the Bank’s presence in northeast Wisconsin.

2016

Mobile Banking App Launched

Introduced our mobile app, bringing banking to your fingertips.

1941

Marion State Bank Begins

Founded in 1941, Marion State Bank opened amidst WWII, providing financial stability to its community during uncertain times.

2020

$300 Million in Assets

Celebrated a new milestone with $300 million in assets.

2023

Weyauwega Branch Opens

Welcomed the community to our new Weyauwega branch.

2024

Full-time Spanish Interpreter

Bridging language gaps to ensure effective communication with Spanish-speaking customers.

2024

ITMs Launched

Our Virtual Tellers were introduced with the launch of our Interactive Teller Machine.

2024

Newly Built Winneconne Branch Opens

Opened our state-of-the-art branch in Winneconne, reflecting our commitment to innovation.

2024

$500 Million in Assets

Half a billion strong: The Bank reached a key milestone of $500 million in assets.

2025

Introduced Full-time Fraud Specialist

Added a position solely dedicated to assist and educate customers on fraud.

2026

More To Come..

2025

Introduced Full-time Fraud Specialist

Added a position solely dedicated to assist and educate customers on fraud.